Introduction to Health Insurance Plans

Navigating the world of health insurance can feel overwhelming with the variety of options available. Among the most common plans are HMO, PPO, and EPO, each offering unique structures for accessing healthcare services. These plans differ in terms of provider networks, costs, and the level of flexibility they provide. Understanding these distinctions is essential for finding a plan that aligns with your healthcare preferences and financial situation.

Understanding HMO Plans

HMO plans are structured around a network of healthcare providers, requiring members to select a primary care physician (PCP) who acts as the central coordinator for their medical needs. The PCP manages routine care and determines when a specialist referral is necessary. All non-emergency services must be accessed through providers within the HMO network. This network-focused approach helps streamline care and often keeps costs lower compared to other plan types.

One of the key benefits of an HMO plan is its affordability. Premiums and out-of-pocket costs, such as copayments and deductibles, tend to be lower than those of other plans. This makes HMOs an attractive option for individuals and families looking to manage healthcare expenses. The emphasis on preventive care, including routine checkups, screenings, and vaccinations, is another hallmark of these plans, promoting better overall health.

However, the requirement to stay within the network can feel restrictive to some. If you wish to see a specialist, you’ll need a referral from your PCP, which could lead to additional steps and potential delays. Furthermore, out-of-network care is typically not covered unless it’s an emergency, which limits your choice of providers.

HMO plans work best for individuals who prefer coordinated care and don’t anticipate needing services outside their network. If your preferred doctors and facilities are part of the HMO network, this plan could provide significant savings while maintaining quality care.

Exploring PPO Plans

PPO plans are designed to offer members greater flexibility when accessing healthcare services. With a PPO, you can visit any doctor or specialist without needing a referral, which can save time and provide convenience for those who regularly require specialized care. While it is generally more cost-effective to use providers within the plan’s network, you also have the option to seek care from out-of-network providers, though this typically results in higher out-of-pocket costs.

One of the primary advantages of a PPO plan is the wide range of provider choices it offers. This is especially beneficial for individuals who have existing relationships with doctors or specialists who may not be included in narrower networks. For those who travel frequently or live in areas where the local network is limited, the ability to seek out-of-network care can provide peace of mind and ensure continued access to the services you need.

However, the added flexibility and broader access to providers come with higher costs compared to more restrictive plans. Premiums for PPOs are often higher than those of HMO or EPO plans, and out-of-pocket costs, such as deductibles and coinsurance, can add up quickly if you choose to go outside the network.

Unlike HMO plans, PPO members are not required to designate a primary care physician, nor do they need to navigate a referral process to see specialists. This can reduce barriers to care and make it easier to schedule appointments directly with the providers you need.

PPOs also tend to have larger networks compared to HMOs, meaning you are more likely to find in-network providers in your area, which can help offset some of the higher costs. That said, it is essential to review the plan’s network details to ensure your preferred doctors and facilities are included.

For individuals or families who prioritize provider flexibility and do not mind paying more for access to a broader range of options, a PPO plan can be an excellent choice. Whether you require specialized treatments, prefer to skip referrals, or want the option to receive care outside the network, this type of plan offers significant versatility.

Insights into EPO Plans

EPO plans offer a balance between affordability and flexibility, making them an appealing choice for many. These plans typically feature lower premiums compared to PPOs while still allowing members to see specialists without needing a referral. For individuals who want a straightforward approach to accessing care without navigating a referral process, this can be a valuable benefit.

However, EPO plans operate within a network, meaning members must use in-network providers for all non-emergency services. This can help control costs, as providers within the network usually agree to negotiated rates, but it does limit the ability to seek care outside of the network. If you choose to see an out-of-network provider, the costs will not be covered except in emergencies, which may be restrictive for those who prefer specific doctors or hospitals that are not included.

One advantage of an EPO plan is that it eliminates the extra steps involved in coordinating care through a primary care physician. Members can schedule appointments directly with specialists, making it easier to address medical concerns promptly. At the same time, these plans often feature more affordable premiums compared to PPO options, which can help families or individuals on a budget access the care they need.

EPO networks tend to be narrower than PPOs but are generally more expansive than those offered under an HMO. Before selecting an EPO plan, it is essential to carefully review the list of in-network providers to ensure that your preferred doctors and medical facilities are included. For those who frequently travel, it’s also a good idea to confirm whether the network has sufficient providers in other areas you may visit.

These plans may appeal to individuals who are comfortable working within a defined network and don’t anticipate needing out-of-network services. The combination of not requiring referrals and offering lower premiums can make EPOs a practical choice for those who value both convenience and cost savings. Additionally, for people who prioritize simplicity in their healthcare plan and prefer a more direct approach to accessing specialists, EPOs can be a compelling option to consider.

Comparing Costs and Coverage

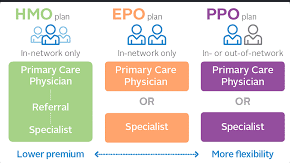

When evaluating costs and coverage, it’s important to understand how each plan type structures expenses and services. HMO plans typically feature lower premiums and predictable out-of-pocket costs, such as set copayments for doctor visits. However, their strict in-network requirements may mean fewer choices for care. EPO plans strike a balance with moderately priced premiums while still maintaining in-network restrictions, though they do not require referrals to see specialists. On the other hand, PPO plans generally have higher premiums and deductibles, reflecting the added flexibility to use both in-network and out-of-network providers.

The way these plans handle coverage also varies significantly. HMOs and EPOs require members to stay within their designated networks for non-emergency care. In contrast, PPOs provide access to out-of-network care, albeit at a higher out-of-pocket cost, which can be useful for those with specific provider preferences. For individuals who prioritize freedom of choice, this coverage structure can be worth the additional expense.

Another factor to consider is how costs are shared between the insurer and the member. PPO plans often involve coinsurance for services, especially for out-of-network care, meaning a percentage of the bill must be paid by the member. EPOs, while offering lower premiums, might include higher deductibles compared to HMOs, requiring members to pay a certain amount upfront before insurance coverage kicks in. Copayments for both HMOs and EPOs are generally fixed, making it easier to anticipate routine expenses.

Additionally, the scope of provider networks can influence both cost and convenience. HMOs typically have more limited networks, offering lower costs in exchange for fewer choices. PPOs have the broadest networks, giving members access to a wide range of providers. EPO networks fall somewhere in between, offering fewer options than PPOs but more than HMOs, which may be suitable for those who want a middle ground.

Understanding these differences in costs and coverage can help individuals choose the health insurance plan that aligns with their financial priorities and care preferences. It’s also essential to consider how often you may need care and whether access to a particular provider is a priority for your health needs.

Making the Right Choice

Choosing the right health insurance plan requires careful consideration of your personal circumstances and priorities. Begin by assessing your healthcare needs, such as whether you expect to need regular doctor visits, specialist care, or specific treatments. If you already have preferred providers, check whether they are included in the plan’s network to ensure continuity of care.

Your financial situation is another critical factor to evaluate. Look beyond the monthly premium and consider other costs like deductibles, copayments, and coinsurance. If you’re looking to minimize out-of-pocket expenses, plans with lower deductibles may be more appropriate, but they might come with higher premiums. On the other hand, if you’re generally healthy and don’t anticipate frequent healthcare needs, a plan with lower premiums and a higher deductible could save you money in the long run.

Flexibility is also key when selecting a plan. If you value the ability to see specialists without a referral or want access to out-of-network providers, a PPO plan may be worth the higher costs. For those who prefer simplicity and are comfortable staying within a defined network, an HMO or EPO might be a better fit. Keep in mind that EPOs offer more freedom compared to HMOs since referrals are not required, but they still restrict coverage to in-network providers.

Location and lifestyle can influence your decision as well. If you travel frequently, having access to a broader network through a PPO may provide greater convenience. Conversely, if you reside in an area with strong networks under HMO or EPO plans, these options may offer both cost savings and accessibility.

Lastly, review the plan details carefully, including the list of covered services, provider networks, and any exclusions. This will help you identify whether a plan aligns with your healthcare needs and financial goals. Taking the time to understand these aspects can help you feel more confident in your decision.

Conclusion and Final Thoughts

Selecting a health insurance plan requires balancing factors like cost, provider access, and flexibility to ensure it meets your unique needs. While HMOs tend to be more affordable and emphasize coordinated care, they require members to stick to in-network providers and follow referral requirements for specialist visits. PPOs, on the other hand, provide greater freedom to choose providers, including those outside the network, but come with higher premiums and out-of-pocket costs. EPOs serve as a middle ground, offering the flexibility to see specialists without referrals while still requiring members to stay within a specific network.

When comparing these plans, it’s helpful to consider how much care you anticipate needing in the near future. Those who expect frequent medical visits or specialized treatments might find the flexibility of a PPO more practical, despite the added costs. Alternatively, individuals who prefer a streamlined, cost-effective approach might lean toward an HMO, provided they’re comfortable with the network restrictions. For those seeking a plan that offers some freedom without the added costs of a PPO, an EPO can strike the right balance.

It’s also important to think about how your lifestyle and location might impact your choice. If your area has strong in-network options for HMO or EPO plans, you may find that these more affordable options provide the coverage you need. However, if you travel often or live in a region with limited network coverage, the broader provider access of a PPO could be beneficial.

Ultimately, selecting a plan involves understanding not only the financial aspects, like premiums, deductibles, and copayments, but also the structure of the plan and how it aligns with your healthcare preferences. Comparing provider networks, reviewing covered services, and identifying any exclusions will help ensure your chosen plan offers the right combination of affordability and accessibility.

By carefully evaluating your priorities and thoroughly reviewing the details of each option, you can choose a plan that supports both your healthcare goals and your financial well-being. Making an informed decision can lead to peace of mind and confidence in your coverage, ensuring you have access to the care you need when you need it.